Maintaining accurate financial records for your business in Xero also recording payroll data and in this blog post we are going to show you how to record your payroll data into Xero.

Unlike most other transactions you will record in Xero, payroll data has to be entered via a ‘manual journal’ (if you are not using Xero’s payroll feature) and below we’ve listed how to do this step-by-step.

Recording the payroll data for your business consists of both expenses (the cost to the business) and liabilities (how much the business owes to employees, HMRC, etc.) and this data once in the accounting software can then allow you to see if you have made the correct payments or if you have made any under/over payments.

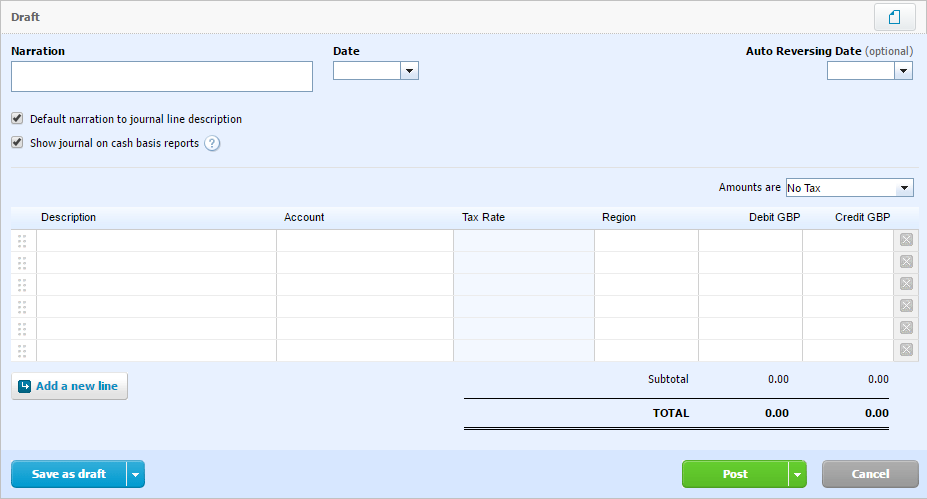

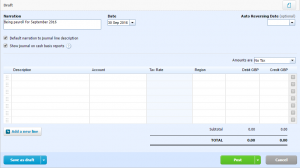

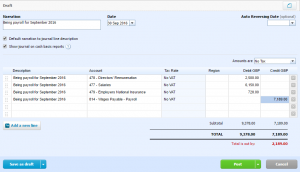

- The first step is opening a new draft manual journal. For those with the advisor role, can access manual journals by clicking the ‘Adviser’ tab and then ‘Manual Journals’. For other users, you can access it by clicking ‘Reports’, ‘Journal Report’ and then ‘Manual Journals’. Once opened you should begin by entering a narration (what the journal is about) and the date.

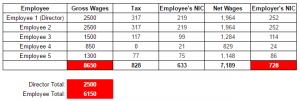

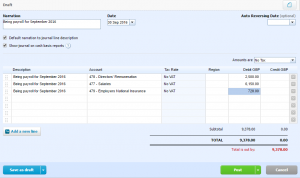

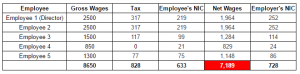

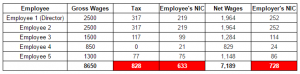

2. Once set up, the first items you should enter are the expenses to the business which consists of the gross wages and the employer’s national insurance contributions as highlighted in this example.

You do so by selecting the relevant expense accounts and enter the totals in the ‘Debit’ column (an increase in an expense).

Note: that Director’s wages and other employee wages are recorded separately.

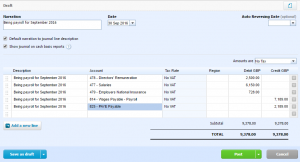

3. You then move onto entering the liabilities. In this example, we enter what is owed to the employee’s (net wages) first.

We enter these amounts on the ‘Credit’ side of the journal (an increase in liabilities)

4. You then add what is owed to HMRC.

5. Finally, you should check that the Debit side (expenses) matches the Credit Side (liabilities) and then click ‘Post’.

Once you’ve paid the net wages to employees and taxes to HMRC, during the reconciliation process you should record these payments against the same accounts as entered in the payroll journal (e.g 814 – Wages Payable – Payroll for net wages)

We hope this brief explanation of recording payroll journals in Xero has been informative, however, if you seek further explanation and guidance on this process please do contact us, we’d love to hear from you!

Note: the example in this post uses the standard Xero chart of accounts and does not take into account additional expenses and liabilities that can form part of a payroll run.